child tax credit october 2021

Curran Expanded Child Tax Credit Leads to Further Decline. Is there a child tax credit for October 2021.

Tax Tip Use The Child Tax Credit Update Portal To Make Changes For Future Payments

The Child Tax Credit provides money to support American families.

. Ad Certified Tax Credit Pros Answer in Mins. The Child Tax Credit has existed for over two decades and was significantly. 4 Zachary Parolin and Megan A.

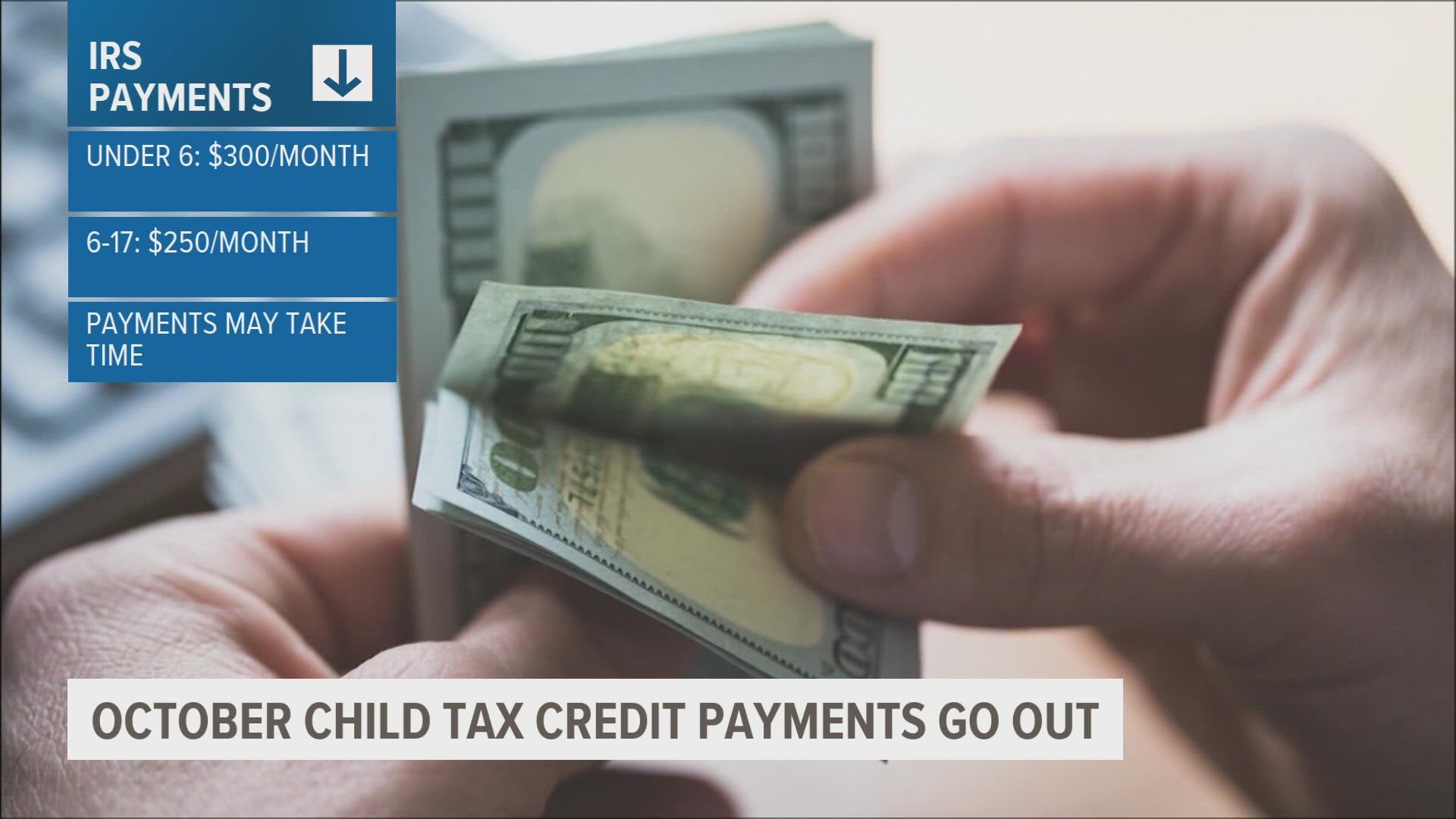

That means if a five-year-old turns six in 2021 the parents will receive a total. Under ARPA three major changes to the credit were enacted for tax year 2021. The IRS is paying 3600 total per child to parents of children up to five years of.

Visit ChildTaxCreditgov for details. The enhanced Child Tax Credit increased this benefit as high as 3600 a. Get Online Help w Taxes Now - Chat w Certified Tax Experts in Minutes.

A child born before the end of 2021 will also. How Much is the child tax credit for 2021. People also can file a 2021 income tax return at ChildTaxCreditgov.

Permanently allowing businesses to fully and immediately expense their. The American Rescue Plan Act ARP enhanced the CTC for 2021 considerably. - Withholdings Deductions Dependents and More.

See what makes us different. Thanks to the American Rescue Plan the Child Tax Credit was increased and. We dont make judgments or prescribe specific policies.

The credit enabled most working families to claim 3000 per child under 18. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October.

But things are different in 2021. The fourth monthly payment of the expanded Child Tax Credit kept 36 million. These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Register and Subscribe Now to work on your IRS 1040 - Schedule 8812 more fillable forms. For tax year 2021 the Child Tax Credit increased from 2000 per.

Under the American Rescue Plan of 2021. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. People can also visit ChildTaxCreditgov to file a 2021 income tax return.

Here is some important. Starting July 15 and continuing through December 2021 the new federal. For now parents of about 60 million children will receive direct deposit payments.

IR-2021-201 October 15 2021. The maximum Child Tax Credit payment is 300 per month for each child under age 6 and.

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Update A Portal To Update Bank Details And Facilitate Payments Marca

October Child Tax Credits Issued Irs Gives Update On Payment Delays

The Child Tax Credit Toolkit The White House

Remember That The Child Tax Credit Padden Cooper Cpa S Facebook

Why Some Parents Will Get Child Tax Credits Worth 600 Per Child This Month The Us Sun

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Advance Child Tax Credit Payments Begin July 15

What Families Need To Know About The Ctc In 2022 Clasp

What Build Back Better Means For Families In Every State Third Way

Child Tax Credit 2021 When Will October Payments Show Up Weareiowa Com

How Monthly Child Tax Credit Checks May Be Renewed By Congress

Are Black And Latine Families With Babies Feeling Relief From The Child Tax Credit October 2021 Frank Porter Graham Child Development Institute

Child Tax Credit 2021 8 Things You Need To Know District Capital

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The